To Lower Property Taxes, a Popular Revenue Source is Available to Seattle: Impact Fees from Developers

Summary & Introduction:

Problem: The Seattle city government continues to struggle to collect revenues sufficient to cover its costs, including for its infrastructure. This fiscal problem is caused by a combination of factors: some revenue sources declining, city government officials struggling to manage existing costs (such as personnel and pensions), and City Hall taking on the cost of new projects and programs (albeit for worthy causes). City Hall has increased sales taxes and property taxes and more increases are on their way for behavioral health and low-income housing. I share the concerns that this cumulative burden on taxpayers could imperil efforts to renew a property tax for transportation projects, including pedestrian safety, bridge safety, transit supports, and street maintenance.

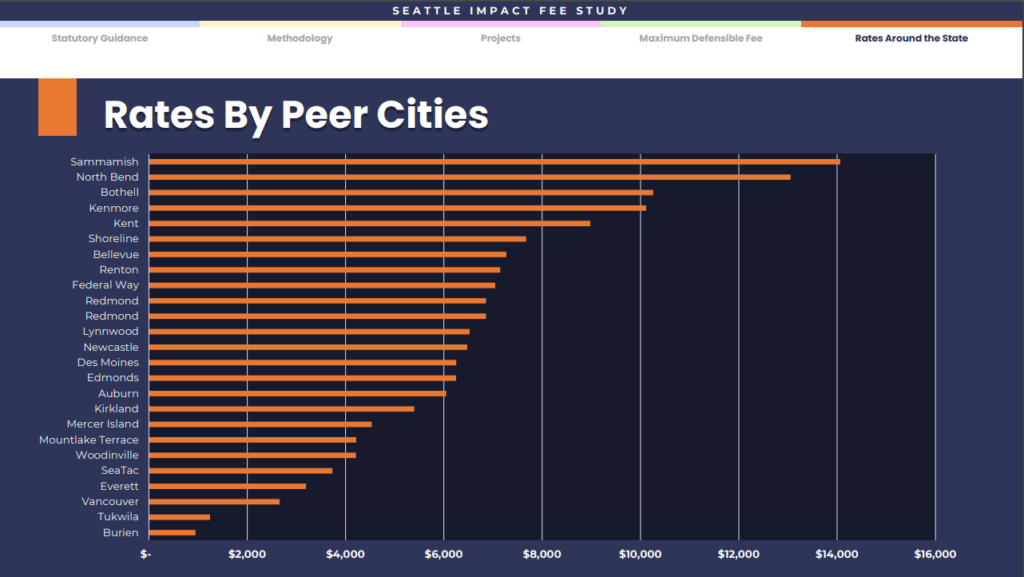

Solution: Impact Fees! State law authorizes local governments to charge “impact fees” to real estate development projects to help pay for the increased burden on our already stressed infrastructure. Impact fees are used by more than 70 Washington State cities and many more across the nation to cover some of a city’s infrastructure costs. Seattle has yet to charge these fees to help pay for its infrastructure and instead passes those costs along to the general public through various taxes. (For the City Council’s website on impact fees, CLICK HERE. For the sluggish progress on this issue over the past decade, keep reading.) The Revised Code of Washington (RCW 82.02.090) authorizes cities to invest the funds raised by impact fees for “(a) Public streets and roads; (b) publicly owned parks, open space, and recreation facilities; (c) school facilities; and (d) fire protection facilities.” For a variety of reasons, the consensus at City Hall is that, IF Seattle imposes impact fees, we would use them for transportation projects to benefit ALL modes of transportation, including pedestrian safety and transit reliability. The good news is that we can exempt low-income housing projects, child care centers, and nonprofit facilities from impact fees. If the City set rates that are comparable to neighboring jurisdictions and if Seattle experiences similar growth to past years, an impact fee program could generate approximately $500 million over 10 years (up to $50 million per year). (For context, the current property tax levy for the “Move Seattle” transportation package is $930 million over the 9 years from 2016 through 2024, which is $100 million per year.)

In the spirit of progressive tax reform — which is long overdue in Seattle — imposing this one-time new fee on just new for-profit real estate development could, in turn, enable City Hall to LOWER an ongoing expense for everyone’s housing: the property taxes charged to everyone for future transportation projects.

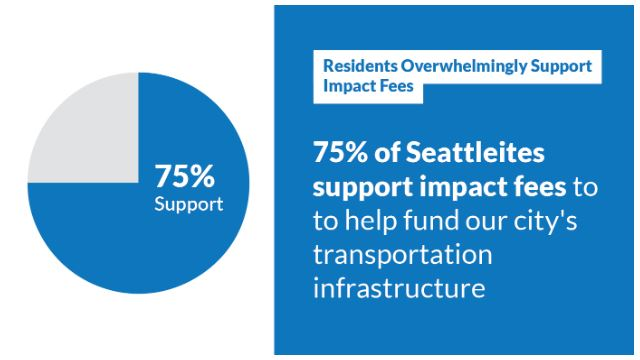

A statistically valid, professional poll conducted in May 2023 revealed that a whopping 75% of Seattle adults SUPPORT these impact fees.

*POWERPOINT: For the presentation from City Council Central Staff at the September 13, 2023 Transportation Committee, CLICK HERE.

It’s high time for Seattle to catch up to cities across the State and nation that collect reasonable impact fees from for-profit real estate developments to ensure our infrastructure is strong and safe.

Next Steps:

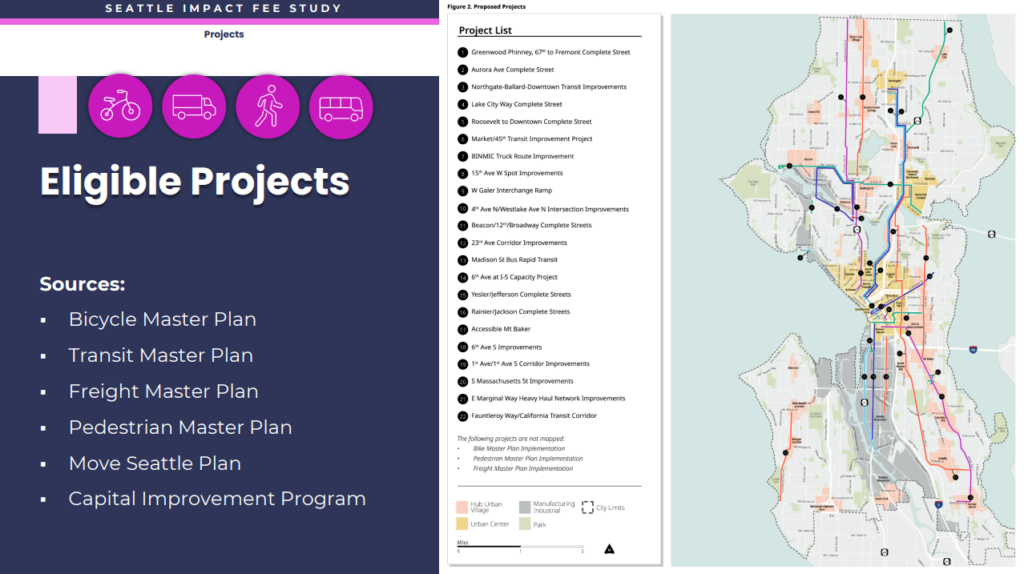

_ Draft a list of transportation projects based on updated rate study. (DONE! CLICK HERE) This includes many existing project proposals for various modes of transportation. This wide range of projects will be reviewed by our City Council’s Transportation Committee in the Spring of 2023.

_ Publish an updated “SEPA Checklist” required by the State Environmental Policy Act (SEPA). (DONE!) Published February 13, 2023. This resulted in an updated Determination of Non-Significance (DNS). In March 2023, developers appealed the City’s determination but, on November 6, 2023, the Hearing Examiner upheld the City’s determination.

_ Docket/Schedule (again) and then adopt an annual amendment to the Comprehensive Plan to authorize real estate developer impact fees. (The “Transportation Element” of the Comp Plan.) This action would be similar to previous annual amendments and should have been routine and accomplished as early as May 2023. Instead this will need to happen when the City adopts its annual budget around November 21, 2023. (There is a public hearing Tuesday, November 7 at 2:00 p.m. for just the proposed amendment (Council Bill 120635) to the Comp Plan. To call into public comment: https://www.seattle.gov/council/committees/public-comment or email Council@seattle.gov. This legislation does not implement a program, but is necessary for next steps. )

_ Consider adopting a transportation impact implementation ordinance(s) to set the fees. This is where the rubber meets the road, so to speak. Note: Even those who don’t like impact fees should not stand in the way of Seattle City Hall crafting the program for consideration. Let’s at least complete the legwork during the summer of 2023 to set up the program and fee structure; we are likely to need that revenue if we want to renew the “Move Seattle” transportation package before it expires in 2024.

Note: The map above from a January 2023 draft report displays some of the projects that can be funded by impact fee revenue. In addition — while not appearing on the map because there would be so many locations across the city — projects from Seattle’s various transportation plans are also eligible (including for transit, bikes, freight, and pedestrian safety).

Recent History (in reverse chronological order):

November 21, 2023: Procedural legislation to allow further discussion of this key alternative funding option to lower property taxes is narrowly defeated; local for-profit developers and their attorneys celebrate (again).

Unfortunately, Council Bill 120635 failed by a narrow vote of 4 in favor and 5 against. Voting against the ability to have a timely debate so that property taxes could be lowered next year were Councilmembers Andrew Lewis, Tammy Morales, Teresa Mosqueda, Sara Nelson, and Land Use Chair Dan Strauss.

I’m very grateful to Council President Debora Juarez for her courageous Yes vote, after carefully and independently considering the various factors. I’m also grateful to the work on this issue by our City Council Central Staff, City Attorney’s Office, a wide spectrum of other Councilmembers (Bagshaw, Herbold, Licata, O’Brien, Rasmussen, Sawant), and community leaders stretching back for more than a decade.

It’s unfortunate that yesterday’s short-sighted vote by a majority against this overdue, necessary step forward means City Hall is likely again to try to foist the entire cost burden onto the ever-growing property taxes and regressive sales taxes.

For a Seattle Times article about the final vote, CLICK HERE.

November 20, 2023: Seattle Times Editorial Board endorses Council Bill 120635

Here’s an excerpt in support of the legislation:

“With the likely renewal of the nine-year Seattle transportation property tax levy on the ballot next year — with a possible price tag of more than a $1 billion — it is past time to lessen the burden for current residents. The bill to be decided by the City Council on Nov. 21 doesn’t enact transportation impact fees… it simply amends the Seattle Comprehensive Plan to show how impact fees could be implemented should the mayor and City Council choose to adopt them in the future. The fees would partially pay for transportation projects such as sidewalks, bridge safety and bike lanes by imposing fees on developers. Low-income housing, day cares and some other facilities could be exempt…

Imposing reasonable fees is the way to ensure the community impacts of new housing are not entirely borne by those who derive little or no benefit from such growth — homeowners and renters who currently pay property taxes. The council has fitfully contemplated transportation impact fees since 2014, and they have been discussed since the late 1990s at least. It’s past time for action. The council should approve the Herbold and Pedersen-sponsored legislation.”

To read the Seattle Times editorial, CLICK HERE.

November 7, 2023 at 2:00 pm: Public Hearing on Council Bill 120635, the overdue amendment to the Comp Plan to allow for a future discussion of Transportation Impact Fees.

To call into public comment: https://www.seattle.gov/council/committees/public-comment or email Council@seattle.gov. Note: This legislation does not implement a program, but is necessary for next steps.

November 6, 2023: Seattle‘s Hearing Examiner Rules In Favor of the City: The Vote to Amend the Comprehensive Plan for Transportation Impact Fees Can Proceed

Seattle’s Hearing Examiner ruled today in favor of the City’s determination that the proposed amendment to the Comprehensive Plan regarding transportation impact fees is “non-significant” under the State Environmental Policy Act (SEPA).

The Hearing Examiner wrote, “The City of Seattle Council Central Staff Division of the City Council (“City”) issued a State Environmental Policy Act (“SEPA”) Determination of Non-Significance (“DNS”) for a proposed ordinance that would modify the Seattle Comprehensive Plan (“Ordinance”). The Appellant Seattle Mobility Coalition (“Appellant”), exercised the right to appeal pursuant to Chapter 25.05 Seattle Municipal Code. The appeal hearing was held on September 5, 6, and 7, 2023, before the Hearing Examiner. The Appellant was represented by David P. Carpman, attorney-at-law, and the City was represented by Elizabeth E. Anderson, attorney-at-law. The parties submitted closing briefs on September 22, 2023, and response briefs on September 28, 2023.”

The Hearing Examiner’s conclusion was clear: “The Determination of Non-Significance is UPHELD, and the appeal is DENIED.”

In a press release, Councilmember Lisa Herbold stated, “I am relieved that the ruling today means that we are going to finally going to be able to have this vote [on Council Bill 120635]. In 2017, Council made a commitment that the City would consider including in the Comp Plan a list of priority transit, pedestrian and bike safety, and bridge projects that Seattle could consider funding with a transportation impact fee program, if legislation implementing the program was adopted later. Council restated that commitment to the public by passing additional resolutions in 2020, 2021, and 2022. What has kept Council from deliberating about this revenue tool have been successive lawsuits opposing even the recognition of these 25 priority projects as ones that would be eligible if a program were enacted in the future. The City has been trying hard to identify new revenue in anticipation of a 2024 revenue gap.”

The vote on Council Bill 120635 to amend the Comp Plan is timed to occur when the City Council adopts its budget, which is scheduled for November 21, 2023. Note: CB 120635 does NOT enact impact fees, but rather completes a necessary step toward having a more robust discussion to craft an actual program.

For the Hearing Examiner’s decision, CLICK HERE, and scroll down to the “Findings and Decision” posted 11/6/2023.

September 13, 2023: Land Use Committee Discusses Transportation Impact Fee Amendment to Seattle’s Comprehensive Plan

Nearly four months after the legislation was crafted, the Land Use Committee finally had a “Briefing & Discussion” of Council Bill 120635, which is a minor procedural step needed to enable City Council to consider a transportation impact fee program. Here’s the bill title: “AN ORDINANCE amending the Seattle Comprehensive Plan to incorporate changes related to a transportation impact fee program proposed as part of the 2022-2023 Comprehensive Plan annual amendment process.” Unfortunately, the Chair deleted the required public hearing portion, even though it was correctly noticed 30 days beforehand. So we’ll need to have that public hearing in October or November before the Council adopts Council Bill 120635 at the same time the Council adopts the City budget (assuming the appeal by developers to the Hearing Examiner is resolved by then).

Here are my comments at our weekly “Council Briefing” on September 11, 2023:

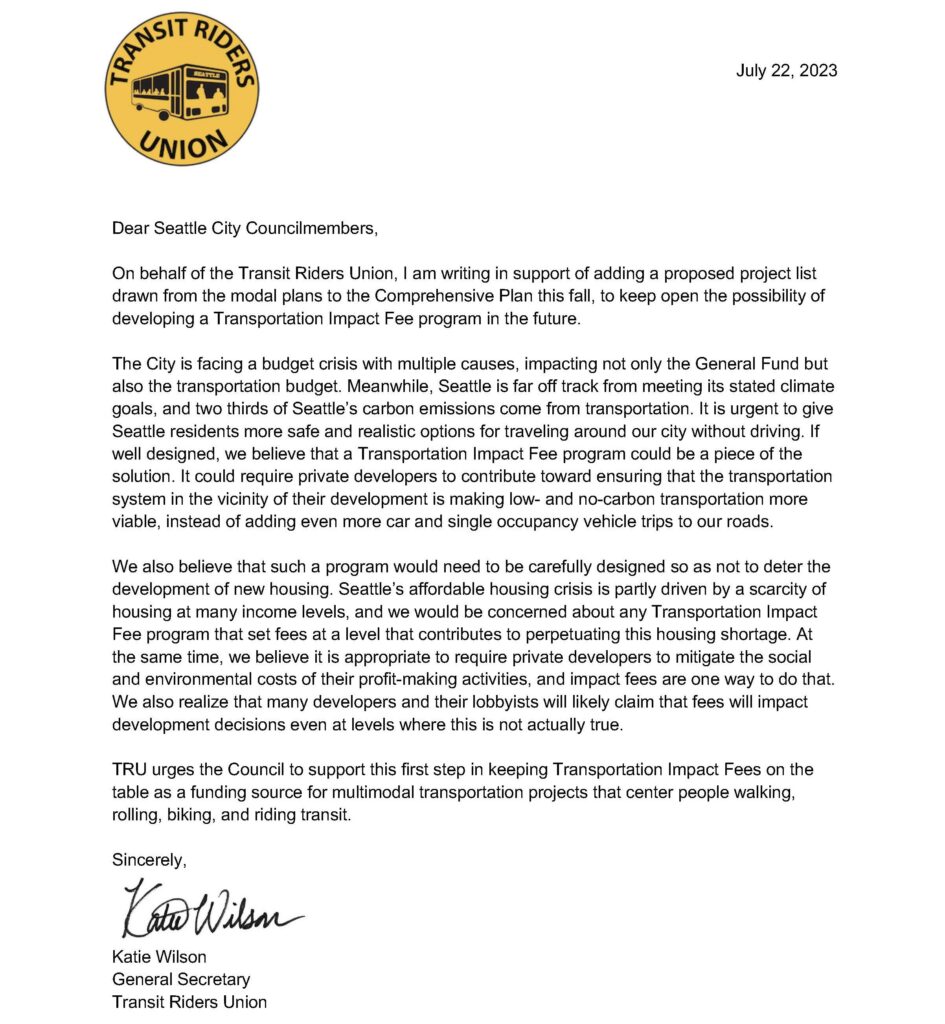

“I want to thank all the committee members who were able to participate in the Transportation Committee meeting on September 5. While our committee was reiterating the type of transportation projects that can be funded by transportation impact fees, Councilmember Morales and Sawant joined me and Councilmember Herbold in supporting an amendment to the Comprehensive Plan that is a necessary step before City Hall can authorize Impact Fees here in Seattle. This support is in addition to a recent survey showing 75% support in Seattle as well as support for this Comp Plan amendment update from the Transit Riders Union and Disability Mobility Initiative. As we already know, Impact Fees are utilized in 70 other Washington cities, which makes Seattle an outlier that puts cost the burden onto property taxes instead. I appreciate that we’ll have a Briefing & Discussion for that Council Bill 120635 in the Land Use Committee this coming Wednesday at 2:00 p.m.

We will also need to have a public hearing for that Council Bill, if not this Wednesday, then BEFORE Council adopts the budget near the end of November.“

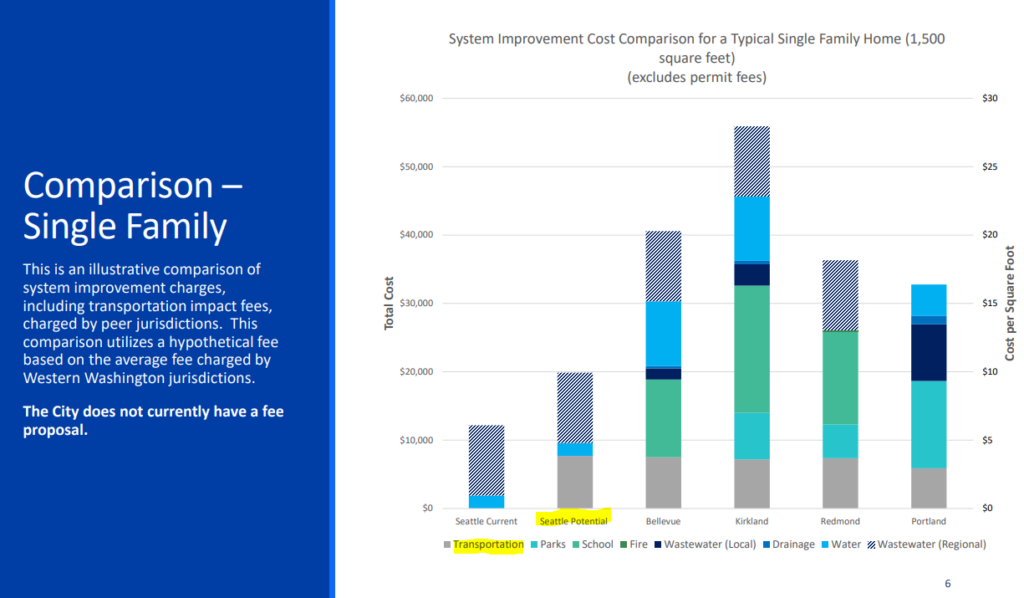

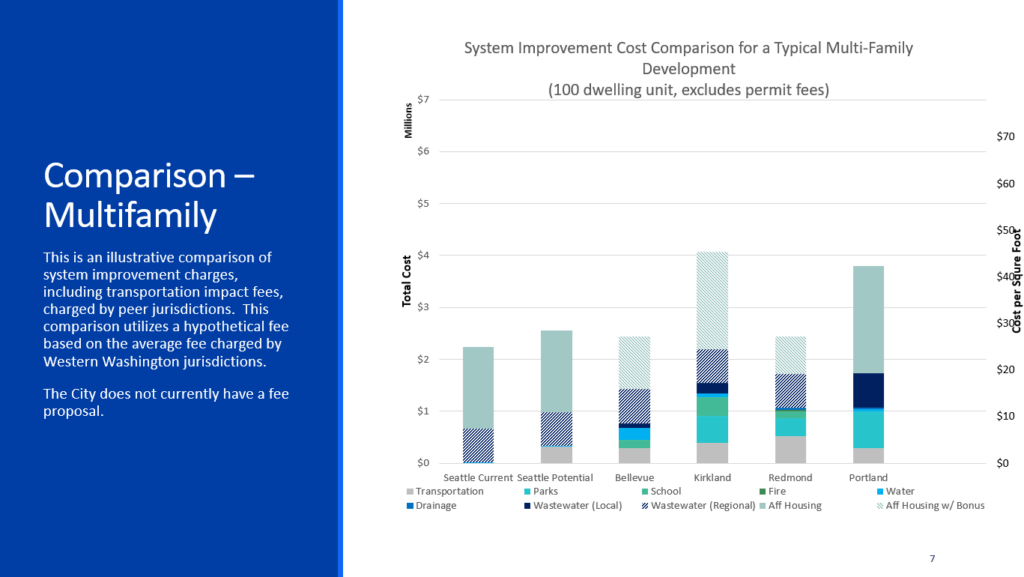

Here’s a key point presented by the City Council Central staff at this Land Use Committee: One of the concerns raised by people afraid of impact fees is that such fees could put Seattle at a development disadvantage, even though 70 other cities in Washington State already charge impact fees. Some argue that other cities don’t charge the “Mandatory Housing Affordability” (MHA) fees that Seattle charges, even though some cities actually do charge similar fees. Moreover, MHA fees are collected IN EXCHANGE FOR the developer being granted additional buildable density by City Hall. Nevertheless, the following bar charts show that, overall, Seattle would still have either lower fees or still be competitive with other cities when combining MHA fees with new impact fees to help pay for transportation projects:

- For a link to Council Bill 120635 and the supporting materials, CLICK HERE.

- For the Land Use Committee agenda for September 13, 2023, CLICK HERE.

August 16, 2023: Disability Mobility Initiative Supports Impact Fees as Possible Source of Funding for Sidewalks

July 22, 2023: Transit Riders Union Supports Next Steps Toward Impact Fees

May 31, 2023: A statistically valid, professional poll conducted in May 2023 revealed that a whopping 75% of Seattle adults SUPPORT these one-time impact fees on new for-profit real estate developments.

- The initial question: Seattle may consider imposing fees on new real estate development projects to help pay for the city’s growing needs for transportation infrastructure. (For example, a real estate developer may have to pay $8,000 to the City government on a condominium project the developer hopes to sell for $800,000.) Would you support or oppose these transportation impact fees on new real estate developments to help pay for transportation infrastructure? 75% support.

- 2nd question to “stress-test” the concept: Some opponents of transportation impact fees say they would increase the cost of housing during a housing shortage. Based on this, would you support or oppose these transportation impact fees on new real estate developments? Still a majority of support (55% support).

- 3rd question (to provide a rebuttal to critics): Some supporters of transportation impact fees say that without the fees, policy makers will likely increase property taxes and sales taxes to generate the same amount of revenue. Based on this, would you support or oppose these transportation impact fees on new real estate developments? Support bounces back to an impressive 2/3 (67% support).

March 28, 2023: City Hearing Examiner set the initial schedule to consider official objections from some landowners/developers of the City’s “determination of non-significance” for future transportation impact fees.

Among the duties of our City Hearing Examiner is to hear certain appeals of environmental impact statement conclusions, such as this updated “determination of non-significance” for transportation impact fees. According to their website, “The Office is charged with conducting fair and impartial administrative hearings, when authorized by the Code, to review the actions of various City departments.” The Hearing Examiner File Number for this case is W-23-001. To see ongoing documents related to this appeal, CLICK HERE. If the hearing moves forward, the tentative starting date is May 23, 2023, according to the Hearing Examiner’s “Pre-Hearing Order.” No matter what happens, the lawyers always win.

March 21, 2023: Presentation on Projects That Could Benefit from Transportation Impact Fees.

The City Council’s Transportation Committee had a briefing and discussion on the history of impact fees and transportation projects that could benefit from this potential new source of revenue.

- For the City Council Central Staff presentation (“Background and Legislative History”), CLICK HERE.

- For the presentation from the expert consultant Fehr & Peers, CLICK HERE.

- For the consultant’s full draft study dated January 2023 (and referenced elsewhere in this blog post), CLICK HERE.

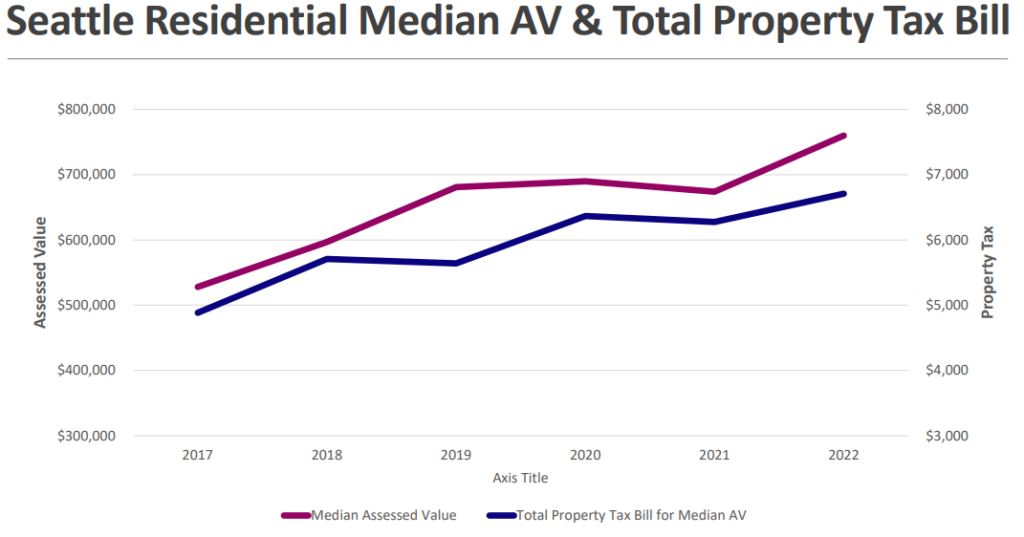

March 20, 2023: Property Tax Impacts Presented to Entire City Council

The entire City Council received a detailed briefing on the increasing burden of property taxes. For the PowerPoint presentation, CLICK HERE. If Seattle finally got for-profit real estate developers to pay reasonable impact fees (as they do in 70 other Washington cities), City Hall could reduce the amount of property taxes everyone pays for our city’s next transportation infrastructure package.

March 6, 2023: A small group of large landowners filed an appeal to the DNS (CLICK HERE).

Seattle Councilmembers Lisa Herbold and Alex Pedersen Respond to Appeal That Is Stalling Deliberations on Possible Funding to Support Transit, Pedestrian and Bike Safety, and Bridge Projects:

“Seattle struggles to generate enough money for the safe streets and bridge projects we need, so I am disappointed that this small group of large landowners would lawyer up to appeal and delay the sensible option of authorizing transportation impact fees, which most other cities in Washington State and across the nation already use to benefit their infrastructure,” said Councilmember Alex Pedersen (Chair of the Transportation Committee, District 4, Northeast Seattle). “As Transportation Chair, I look forward to discussing in our committee the many transportation projects that could benefit from this State-authorized revenue source already used by more than 70 other Washington cities.”

“In 2017 Council made a commitment that the City would consider including in the Comp Plan a list of priority transit, pedestrian and bike safety, and bridge projects that we could consider funding with a transportation impact fee program, if legislation implementing the program was adopted later,” said Councilmember Lisa Herbold (Chair of the Public Safety Committee, District 1, West Seattle). “Council restated that commitment to the public by passing additional resolutions in 2020, 2021, and 2022. What has kept Council from deliberating about this revenue tool have been successive lawsuits opposing even the recognition of these 25 priority projects as ones that would be eligible if a program were enacted in the future. The City has been trying hard to identify new revenue in anticipation of a 2024 revenue gap. Those most benefiting from growth shouldn’t stop civic stakeholders from having this necessary policy discussion.”

February 13, 2023: Updated “Determination of Non-Significance” (DNS) published by City Council Central Staff. For the 4-page DNS document, CLICK HERE. For the 2-page public notice, CLICK HERE. Here is an excerpt from the notice:

“The City of Seattle is proposing to amend the Comprehensive Plan to facilitate implementation of a transportation impact fee program. The proposed amendments would: (1) amend the Transportation Element of the Comprehensive Plan and a related appendix to identify deficiencies in the transportation system associated with new development; (2) incorporate a list of transportation infrastructure projects that would add capacity to help remedy system deficiencies; and (3) establish policies of considering locational discounts for urban centers and villages and exemptions for low-income housing, early-learning facilities and other activities with a public purpose for any future rate-setting. The amendments are a necessary, but not sufficient step, to establish an impact fee program under RCW 82.02.050.

“Environmental review of the proposal has been conducted again pursuant to the amended Findings and Decision of the Hearing Examiner dated October 24, 2019, Hearing Examiner Case File: W-18-013.

“ENVIRONMENTAL DETERMINATION After review of a completed environmental checklist and other information on file, the Legislative Department has determined that the amendments described above will not have probable, significant adverse environmental impacts and has issued a Determination of Non-Significance (DNS) under the State Environmental Policy Act (no Environmental Impact Statement required).”

The updated SEPA Checklist is, unfortunately, what is being appealed by a small group of large landowners. The City Hearing Examiner will make the decision on the appeal.

September 2022 Annual Comp Plan Amendment: The Council unanimously adopted Resolution 32068 “relating to proposed Comprehensive Plan amendments proposed to be considered for possible adoption in 2023” which included Impact Fees:

- “B6. Impact fee amendments. In conjunction with the Seattle Department of Transportation’s (SDOT’s) Seattle Transportation Plan, consider potential amendments to the Comprehensive Plan necessary to support implementation of an impact fee program for public streets, roads, and other transportation improvements. This impact fee work may include amendments to update or replace level-of-service standards or to add impact fee project lists in the Capital Facilities Element and amendments to other elements or maps in the Comprehensive Plan, as appropriate. In addition, consider impact fee amendments related to publicly owned parks, open space, and recreation facilities, and school facilities as discussed in Resolutions 31762, 31970, 32010.”

July 2020: Impact Fees called for in renewal of the Seattle Transportation Benefit District (STBD). STBD is funded by a regressive sales tax. (A sales tax is “regressive” because those with lower incomes pay a greater portion of their household income for that tax than do higher income families). Council Bill 119833 / Ordinance 126115, which put the renewal of STBD on the November 2020 ballot, was approved unanimously by the 2020 City Council but many Councilmembers expressed concern that the funding source is regressive. Partly because the sales tax is regressive, a majority of the City Council included in that ordinance the following recitals calling for impact fees:

- “WHEREAS, Developer Impact Fees could be established as early as 2021 to increase funding to buy bus service hours from Metro; and

- WHEREAS, Developer Impact Fees are a progressive funding source paid for by large, corporate developers; and

- WHEREAS, the Seattle City Council intends to complete in 2020 any required SEPA analysis to enable Developer Impact Fees to be enacted in 2021; and

- WHEREAS, the Seattle City Council is committed to enacting Developer Impact Fees in 2021 to raise not less than $44 million which would allow Seattle to increase funding for Metro bus hours; and

- WHEREAS, in response to public requests that the City pursue progressive sources of revenue to supplement the STBD, the City Council intends to consider imposing a transportation development impact fee under RCW 36.73 or RCW 82.02, which could fund necessary capital and other transportation investments that support transit capacity;”

October 24, 2019: Seattle’s Hearing Examiner Ryan Vancil decides the City Council’s Determination of Non-Significance needs more information. The Amended Findings and Decision concludes, “The City must issue a new threshold determination.” (Hearing Examiner Case Number W-18-013)

October 25, 2018: City Council publishes its original Determination of Non-Significance (DNS) for impact fees. Unfortunately, the DNS is appealed on November 15, 2018 by members of the local real estate industry branding themselves as the “Seattle Mobility Coalition.”

March 2018: Presentation on Impact Fees to City Council’s Transportation Committee (CLICK HERE).

July 26, 2017: Three City Councilmembers published their Op Ed, “Seattle is overdue for developer impact fees.” A leading columnist for the Seattle Times had a similar message on June 15, 2017: “Impact fees are a populist anthem that is being ignored by the city of Seattle. Why?” (CLICK HERE).

2015: The Mayor’s Office, City Budget Office (CBO), Seattle Department of Transportation (SDOT), Department of Planning & Development (DPD), and Parks Department present a work program and preliminary recommendation for developing an impact fee program.

November 2015: 58.6% of voters approved the $930 million property tax (over 9 years) “Levy to Move Seattle,” which funds several transportation capital projects. City Hall is likely to seek a renewal in November 2024, based on the contours of the “Seattle Transportation Plan” SDOT is crafting in 2023.

September 10, 2014: The then-Chair of the Council’s Transportation Committee Tom Rasmussen holds a ground-breaking informational session, which debunks the negative myths about developer fees and shows how behind Seattle is as compared to other jurisdictions. He also led the initial consensus to use impact fees for transportation projects. To watch that video, CLICK HERE.

Here are some findings from the 2014 presentation to City Council:

- Do impact fees make housing less affordable? No. (a) Impact fees are a small % of total cost. (b) Developers already charge the maximum rents that the market can bear; developers cannot simply raise rents if their costs were to increase. For a comparison of costs/fees in other cities (in 2014), showing Seattle had the LOWEST overall fees, click here. NOTE: This was BEFORE the Mandatory Housing Affordability (MHA) program.

- Do impact fees decrease our city’s competitiveness? No. 75 other cities near Seattle charge impact fees as allowed by Washington State law.

- Do impact fees reduce development? No. Two recent rounds of studies (Ferris in Feb 2013 and Rosen in July 2014 / Jacobus in Sept 2014) already demonstrated that projects are still profitable even if they pay additional fees. Cities already charging impact fees still see new projects booming (e.g. Bellevue).

- Is it fair to “pick on” developers? Common in other jurisdictions, impact fees simply get the developers “to join the party. Everybody else is paying for the infrastructure. We’re asking them to pay their share and, therefore, not make taxpayers subsidize” a developer’s new project’s impacts. Moreover, Seattle residents have invested their tax dollars and creative energies to make our city a special place to live — and that’s something we have already given to developers and their investors.

Additional Context:

The Seattle city government continues its struggle to collect revenues sufficient to cover its expenses. This fiscal problem is caused by a combination of factors: some revenue sources declining, city government officials failing to manage existing costs (such as personnel and pensions), and City Hall taking on the cost of new projects and programs (albeit for worthy causes).

To boost revenues, thus far, the City Council has recently taken several actions. A majority of the City Council recently imposed a new payroll tax on larger employers. The Mayor and a majority of City Council recently doubled the portion of your property taxes that subsidize Seattle’s parks and recreation programs. (Based on constituent feedback, I voted against both of those increases. I voted against the employer tax mainly because it was proposed during a recession and would make it harder to compete with Bellevue. I voted against the doubling of the parks district tax mainly because it was too large and lacked justification.)

For November 2023, the Mayor and City Council are poised to ask voters to TRIPLE the portion of your property taxes that subsidize low-income housing projects. These city government tax increases would be in addition to tax increases by your King County government. I’m concerned this cumulative burden on taxpayers will imperil efforts to renew a property tax for transportation projects, including pedestrian safety, bridge safety, transit supports, and street maintenance.

While City Hall continues to increase your property taxes at a relatively aggressive pace, some are also calling for “progressive revenue” (in addition to the recently imposed employer payroll tax). But is it necessary to create a new tax when State law already clearly authorizes Seattle to charge impact fees to profitable entities to help offset the costs that increased population growth is having on our infrastructure, including our streets, schools, parks, and fire protection facilities. A large number of cities across the nation collect impact fees from new developments. It’s high time for Seattle to authorize impact fees here.

Alternative View: After feedback from constituents and analyzing this issue for some time, I support reasonable impact fees and the concept seems popular among the general public. However, for an alternate point of view, developer-friendly opinion leaders published contrarian points when the City Council previously considered these fees. You can read the July 2017 column by Roger Valdez: “Charging Impact Fees Will Make Housing Prices Worse” (CLICK HERE). You could also read a Sept 2017 blog post by the Sightline Institute titled “Impact Fees: An Urban Planning Zombie in Need of Slaying” (CLICK HERE). Note: support for Mr. Valdez’s organization “Seattle for Growth” and for “Sightline Institute” includes funding from the real estate development industry. In contrast, my campaign for City Council in 2019 did not accept donations from real estate developers or organizations. Expect to hear those voices and their pro-developer allies to publish similar pieces in 2023. For example, the developer-funded lobbying group “Seattle for everyone” sent a letter dated March 16, 2023 (CLICK HERE).

Here’s a quick attempt to rebut or alleviate a few points from the contrarians:

- Concern Raised by Opponents: “City fees increase the cost of housing while we want more housing.” Initial Response: The cost to build a project does NOT equal the price paid by the consumer. Cost does not equal Price. The classic concern raised is that “developer fees increase the cost of housing.” That claim is misleading, at best. The for-profit market already charges the max that people are willing to pay. If a new cost comes along, the for-profit firm – which is already charging the max the market will bear – cannot magically pass that along to the consumer. Instead, of increasing price, the new costs decrease profit, assuming the developer cannot find offsetting efficiencies or cost reductions elsewhere. While we must be mindful of cumulative costs imposed onto the private sector, we must also be mindful of the cumulative impact of sales taxes and property taxes imposed on the general public. Impact fees in Seattle will have those profiting most immediately from a project finally help to mitigate the impacts of their project on our public infrastructure, instead always foisting 100% of those costs onto the backs of general taxpayers.

- Concern Raised by Opponents: “Impact Fees would be new to Seattle and so we should wait until we renew the Move Seattle transportation package in 2024.” Initial Response: Seattle is already far behind on this progressive revenue source. Scores of other cities have charged impact fees for years. Moreover, our city needs to pay for the increasing costs of growth somehow. The recent update of the Impact Fee Study (completed in January 2023) would actually be right-on-time to enable Seattle to renew/expand the 9-year $930 million “Move Seattle” package (originally approved in 2015 and funded currently by 100% property taxes). That’s because that transportation funding package will be based on the Seattle Transportation Plan, which is being finalized this year (2023). Successfully renewing the “Move Seattle” funding package in 2024 will likely hinge on whether we can show the general public they are not the only ones paying this financial burden. Impact fees are more progressive than regressive sales taxes and the repeated increases in property taxes burdening Seattle homeowners and renters. Putting impact fees in place beforehand will be important to prove to the general public that City Hall has diversified our revenue sources for transportation projects before we ask homeowners and renters to contribute more in 2024.

- Concern Raised by Opponents: “Impact Fees will hurt low-income housing.” Initial Response: Actually, Seattle would likely exempt low-income housing projects from impact fees, and we would likely exempt child care centers and nonprofit facilities as well. All of these exemptions are permitted by State law. Some claim low-income housing would still be negatively impacted because, in Seattle’s more densely populated urban villages and urban centers, for-profit projects are required to either build a small percentage of low-income housing units (under 10%) or pay into an “in lieu” fund which has recently generated $75 million in fees used to subsidize low-income housing projects elsewhere. But several other jurisdictions charge multiple fees or have multiple requirements to help pay for infrastructure impacted by growth. And those jurisdictions don’t offer the same developer benefits that drive demand and prices here in Seattle, such as close proximity to job growth, robust transit, and civic amenities (sports teams, the arts, the best restaurants, etc). As an example, would a new condominium selling for $800,000 really not get built if the developer/investors had to pay the City $8,000 (just 1%)? Each project is different and City Hall would need to review the development spreadsheets to determine for certain whether a project would actually become infeasible. What is known for certain, however, is that Seattle currently doesn’t have enough revenue to create the transportation safety projects Seattle needs.

More Information:

- Municipal Research Services Center (MRSC) explanation of impact fees across Washington State, CLICK HERE.

- City Council website on Impact Fees, CLICK HERE.

- For the City Council Central Staff presentation from March 21, 2023 (“Background and Legislative History”), CLICK HERE.

- RCW 80.02.050 states, it is the intent of the legislature, “To promote orderly growth and development by establishing standards by which counties, cities, and towns may require, by ordinance, that new growth and development pay a proportionate share of the cost of new facilities needed to serve new growth and development.”

- RCW 82.02.060 allows for exemptions, including for low-income housing projects, child care centers, and nonprofit facilities.

- RCW 82.02.090 defines “impact fees.”

# # #

Posted: February 11th, 2023 under Councilmember Pedersen