Time for Tax Fairness in Seattle – Time to Repeal the Tax on Your Drinking Water

Recent History (in reverse chronological order):

August 18, 2023: Seattle Times Editorial Board Calls Pedersen’s Tax Reform “a solid idea.”

The Seattle Times editorial board called Pedersen’s tax reform proposal “a solid idea.” Here’s the excerpt:

“Big picture, I don’t believe City Hall has a revenue problem. It has a spending problem,” said Councilmember Alex Pedersen during a council meeting. He cited several drivers of Seattle budget woes, including increasing wages for city government employees and ballooning pension costs.

Pedersen has suggested instituting a capital-gains tax to replace the regressive tax on drinking water. It’s a solid idea that has garnered support from Chief Seattle Club, Solid Ground and Low Income Housing Institute, among others.”

For the entire editorial published in the Seattle Times August 18, 2023, CLICK HERE.

June 7 through August 4, 2023: More nonprofits and the SPU Customer Review Panel Endorse the Repeal of City Hall’s Tax on Drinking Water

Scroll down for the additional endorsements…

June 7, 2023: The Announcement: our press release has most of the key information about my proposal:

Councilmember Pedersen launches bold tax reform to make the system more fair for Seattle

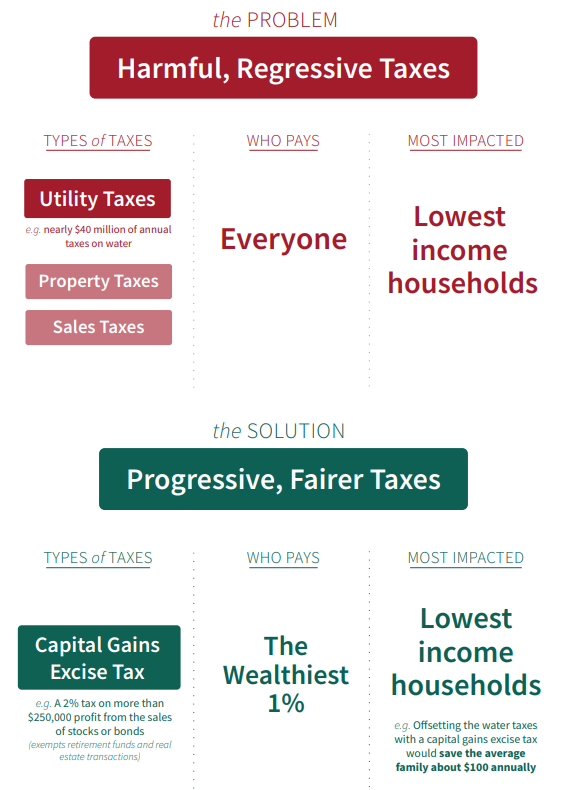

Pedersen’s fiscally responsible tax reform legislation would, for the first time, eliminate a regressive tax for everyone and offset that water tax revenue with a local 2% capital gains excise tax.

SEATTLE – Councilmember Alex Pedersen (District 4 – Northeast Seattle) announced today a bold tax reform to make our system more fair for Seattle with legislation eliminating a regressive water tax for everyone and replacing it with a 2% local expansion of the State’s new progressive tax on high-end capital gains.

“Everyone knows the people of Seattle have suffered too long from one of the most regressive tax systems in the nation,” said Councilmember Pedersen, chair of City Council’s Transportation and Seattle Public Utilities Committee. “Because tax reform for tax fairness is overdue in Seattle, I am introducing legislation to eliminate our regressive and arbitrary tax on everyone’s drinking water and replacing it with a reasonable 2% capital gains excise tax on large, non-retirement financial gains to match the new State law. The top 1% can afford to pay this 2%. Adopting a more fair and progressive capital gains tax would ensure no one has to pay taxes for their drinking water in Seattle, making this the first time City Hall has proactively eliminated a regressive tax.”

Matching the new State law, this local tax would apply to only a very small number who gain more than $250,000 in a single year from the sale of assets, such as stocks or bonds, and it would exempt retirement savings and real estate transactions. Using zip code-level information gathered for the state-level capital gains excise tax, a local 2% could generate approximately $50 million annually, which would offset the amount City Hall’s General Fund takes from your water bills each year, so that this tax reform is essentially revenue-neutral.

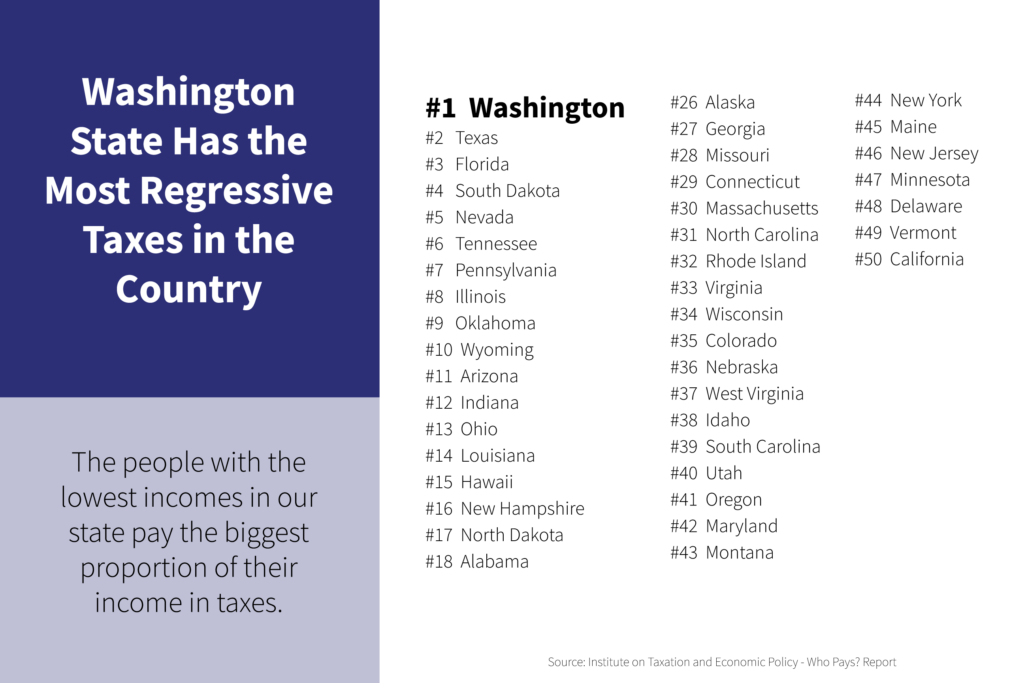

The Institute for Taxation and Economic Policy (ITEP) consistently ranks Washington State as one of the most unfair systems in the country, where lower income residents pay a much higher percentage of their household earnings for taxes and fees than wealthier residents.

Pedersen’s plan for Seattle tax reform would utilize the revenue from the capital gains tax to eliminate one of our most regressive forms of taxation: the utility tax on water. As our system currently stands, households and businesses are not only charged for the cost of the water from Seattle Public Utilities, but also taxed on that same water by City Hall at an arbitrary rate of 15.54%. The revenue from the regressive water tax flows into the city government’s General Fund, which supports various City-funded operations.

For a typical household in Seattle, eliminating the water tax is likely to save at least $100 per year.

Support from Key Stakeholders:

NEW: Derrick Belgarde, Executive Director of the nonprofit Chief Seattle Club said, “Seattle’s water utility tax places a disproportionate burden on low-income communities and our members. Repealing this regressive tax will allow more of our members’ income to be focused on their healing & recovery as they move forward on a journey to being healthy & housed in supportive environments. We must break down all barriers that create homelessness or housing instability without limiting our resources to address these crises in our urban Native Communities.”

Derrick Belgarde, Chief Seattle Club

NEW: Shalimar Gonzales, CEO of the nonprofit Solid Ground said: “There are many barriers to ending poverty that we must break down together and that includes the repeal of regressive taxes and fees that burden lower income households. Consistent with our nonprofit’s mission, I support policymakers repealing Seattle’s utility tax on drinking water and believe replenishing that revenue with a local capital gains excise tax is a solid option.”

Shalimar Gonzales, Solid Ground

NEW: Joe Thompson, Executive Director of Mercy Housing Northwest confirmed their nonprofit endorses this effort: “Our affordable housing communities have been especially burdened by escalating costs for necessities like utilities. We support the effort toward a more fair and equitable approach through the repeal of this regressive tax on drinking water.“

NEW: Sharon Lee, Executive Director of the Low Income Housing Institute (LIHI) said, “The affordable apartment buildings and tiny homes that our nonprofit LIHI builds and manages for low-income people are currently burdened by the city’s water utility tax, so we support local leaders repealing that regressive cost as they seek to make Seattle’s tax system more fair.”

NEW: Marcia Wright-Soika, Executive Director, of the nonprofit FamilyWorks reported that her board approved the following statement of support: “The vast majority of families we serve every day through FamilyWorks’ food banks and resource centers are marginalized by economic injustice. We support efforts to bring relief to low-income families and neighbors by repealing regressive taxes, such as the tax on our drinking water. We hope policymakers center just and progressive revenue options as the pathway to make our city affordable and inclusive for all.”

Marcia Wright-Soika, FamilyWorks

Local small business owner, Molly Moon Neitzel of Molly Moon’s Ice Cream said, “As a small business owner who sees her employees struggling with regressive expenses, I support extending the progressive capital gains excise tax to Seattle to eliminate the city’s tax on everyone’s water bills. Councilmember Pedersen’s legislative proposal is an important part of the solution, as we work toward a more fair economic system.”

John Burbank, founder and retired Executive Director of the Economic Opportunity Institute think tank, said, “Introducing a progressive tax to sunset a regressive tax on everyone is a welcome and elegant step forward in addressing economic inequities in Seattle. Lower income households that pay a greater proportion of their income for their utility bills, including many seniors on fixed incomes, will benefit from eliminating the water tax. I appreciate Councilmember Pedersen for swiftly recognizing this opportunity for greater fairness by leveraging the new State law to benefit the people of Seattle with meaningful tax reform.”

“As members of the Seattle Public Utilities Customer Review Panel, we strongly support the proposed legislation to eliminate the 15.5% utility tax on the sale of water currently imposed on our city residents and businesses…Utility taxes are a regressive form of taxation and disproportionately affect lower income households as they pay a greater share of their income for essential utility services. This creates an affordability challenge for these customers, including many seniors on fixed incomes who do not qualify for the utility discount program for water, sewer and solid waste services. It also increases the cost of doing business for the many small commercial businesses that are integral to the quality of life in our local neighborhoods.”

For the full letter of support from the Customer Review Panel of Seattle Public Utilities, dated August 4, 2023, CLICK HERE.

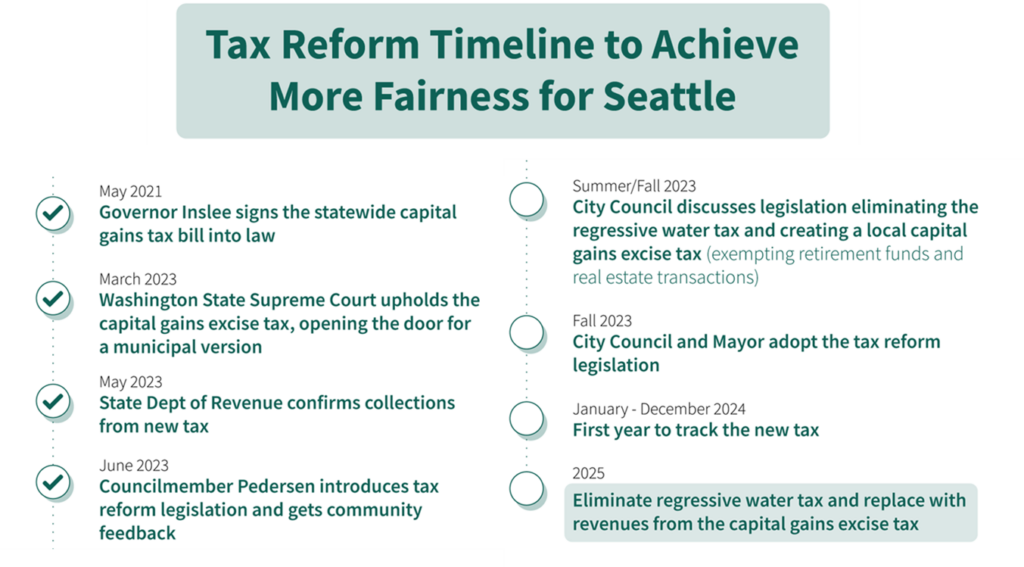

Timing:

Pedersen’s legislation needs to be adopted before the end of 2023 for Seattle to have authority throughout 2024 to track and tax the high-end, annual capital gains within the city limits and then eliminate the regressive water tax for everyone at the end of 2024. Moreover, City Hall has already endorsed for 2024 its $7.4 billion budget (of which $1.6 billion is for the General Fund), and it will require all of 2024 to quantify the capital gains taxes to be collected to offset the water tax. Put simply, Pedersen’s revenue-neutral tax reform legislation must be adopted in 2023 to impact 2025. Not adopting the legislation in 2023 would essentially signify that City Hall leaders remain okay charging its residents the unnecessary, regressive tax on drinking water.

Expanding the State’s new excise tax for high-end ($250,000 or more) capital gains that exempt retirement funds and real estate transactions so that it eliminates a regressive tax paid by everyone in Seattle is prudent and fiscally responsible, considering widespread concern about our city government’s growing budgets. Nearly 60% of Seattle voters said their taxes are too high and nearly two-thirds said they don’t trust City Hall to spend their tax dollars responsibly, according to a survey conducted by EMC Research in April 2023. A revenue-neutral tax reform that, for the first time, proactively eliminates a regressive tax can help to rebuild trust with the majority of residents who are skeptical of financial proposals from City Hall.

As chair of the City Council committee overseeing Seattle Public Utilities, Councilmember Pedersen held a discussion on June 6, 2023 to highlight this regressive taxation on utilities. He also introduced the concept of using the progressive excise tax to provide relief for regressive taxes in his widely distributed newsletters from April and May 2023.

Links to more information:

- For a link to Councilmember Pedersen’s proposed legislation:

- Repeal of the regressive water tax: CLICK HERE for CB 120602.

- Application of the progressive capital gains excise tax: CLICK HERE for CB 120601.

- For my press release on June 7, 2023, CLICK HERE. To see the visuals from the presser, CLICK HERE

- To watch the June 7, 2023 press conference, CLICK HERE.

- For Councilmember Pedersen’s blog post, CLICK HERE or go to: https://pedersen.seattle.gov/

- For June 6, 2023 presentation on “utility taxes” from our City Council Central Staff, CLICK HERE or go to: https://seattle.legistar.com/View.ashx?M=F&ID=12060070&GUID=06C1DFD8-325F-4F52-96A9-80B7E32021D0

- For utility tax information from the non-partisan Municipal Research Services Center, CLICK HERE or go to: https://mrsc.org/explore-topics/finance/revenues/utility-tax

- For a description of the non-retirement capital gains tax from the State Department of Revenue, CLICK HERE or go to: https://dor.wa.gov/taxes-rates/other-taxes/capital-gains-tax (The City would mirror the methodology of the State.)

- For column in GeekWire by Nick Hanauer entitled “7 reasons why the capital gains tax is good for Washington state,” CLICK HERE.

- For the Seattle Times May 26, 2023 article on the capital gains amounts, CLICK HERE or go to: https://www.seattletimes.com/seattle-news/politics/was-new-capital-gains-tax-brings-in-849-million-so-far-much-more-than-expected/ For the related May 27, 2023 column by Danny Westneat, CLICK HERE or go to: https://www.seattletimes.com/seattle-news/politics/was-wealthiest-are-richer-than-even-the-tax-collectors-guessed/

# # #

Media coverage:

- For my press release on June 7, 2023, CLICK HERE. To see the visuals from the presser, CLICK HERE

- To watch the June 7, 2023 press conference, CLICK HERE.

- For the initial article by the Seattle Times, CLICK HERE.

- For the initial article by the Puget Sound Business Journal, June 7, 2023, CLICK HERE.

- For initial concerns raised by the Washington Policy Center, June 12, 2023, CLICK HERE.

- To hear journalists discussing the proposal on KUOW‘s “Week in Review,” CLICK HERE and advance it to 9:30 minutes remaining in the 52-minute segment.

- For KUOW‘s “Seattle Now” podcast “Rethinking Seattle’s regressive taxes,” CLICK HERE.

May 31, 2023: Tax Reform Needed For Fairness: Let’s Stop Taxing Your Drinking Water!

Here’s an except from our newsletter on May 31, 2023. (Hint: read our entire e-newsletter to learn what’s on my mind! To subscribe, CLICK HERE.)

Did you know that City Hall taxes your drinking water? It’s called a “Utility Tax” and it’s authorized under State law. But that doesn’t make it right. For greater fairness, we need tax reform in Seattle, starting with our drinking water.

For years, Seattle politicians have been decrying regressive taxes and yet we continue to charge regressive utility taxes, including on our drinking water. Why? Because our City’s General Fund uses those utility taxes to fund city government operations. Of the approximately $186 million City Hall takes from Seattle Public Utilities (SPU) and Seattle City Light, approximately $37 million comes from your drinking water bill – an arbitrary tax above and beyond the actual drinking water charges from SPU.

For drinking water, residential customers pay a 15.5% tax. While the annual water tax cost for the typical Seattle household is difficult to calculate, figures from previous reports and recent increases indicate it exceeds $100 per year. And that extra water tax is regressive, which means lower-income households pay a greater portion of their household income for this tax. The “Utility Discount Program” is insufficient not only because most eligible families don’t use it, but also because it covers only part of the bill with the remaining portion still a regressive charge by City Hall.

As noted earlier, our Washington State Supreme Court recently allowed the State’s new capital gains excise tax to remain. Thankfully, its first round of collections generated much more than expected, as reported recently by the Seattle Times. The State’s new capital gains excise tax exempts retirement accounts and real estate sales and applies a 7% charge only to capital gains of more than $250,000. (For Frequently Asked Questions about that new excise tax, CLICK HERE.)

An additional 1% to 2% charge of that new capital gains excise tax here in Seattle could remove the water tax paid by all Seattle residents. Instead of just talking about tax reform, let’s do it. We can start by ending the regressive water tax here in Seattle.

For a link to that newsletter, CLICK HERE.

April 26, 2023: New Progressive Taxes Should Be Used to End Regressive Taxes

Here’s an except from our newsletter on April 26, 2023. (Hint: read our entire e-newsletter to learn what’s on my mind! To subscribe, CLICK HERE.)

April Revenue Forecast: City Hall Can Still Pay the Bills, For Now

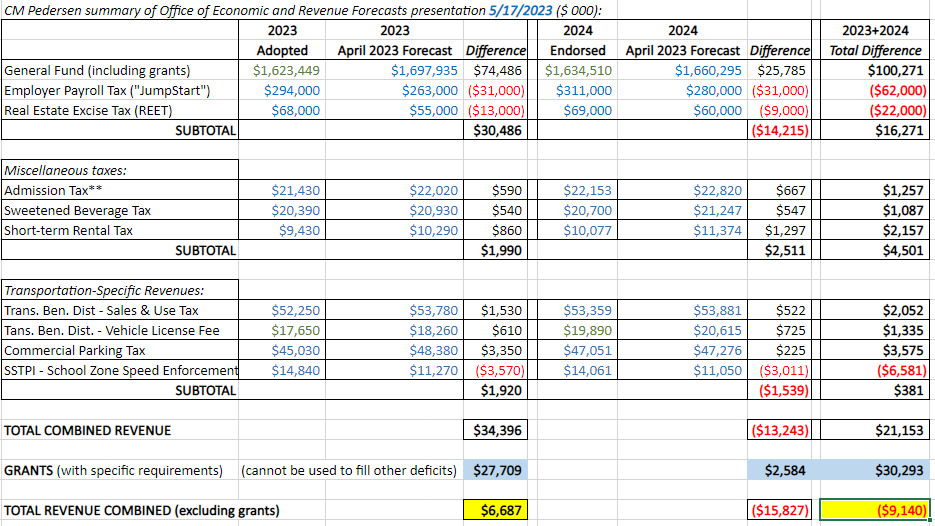

FORECASTING OFFICE: Your city government is likely to enjoy a small budget “surplus” at the end of this calendar year (2023), according to the revised estimates from Seattle’s Office of Economic and Revenue Forecasting. Earlier this month, the forecasting office presented its updated estimates for the revenues available to operate your city government and to deliver its services and programs. The relatively new forecasting office was wisely conceived by previous City Council President Lorena Gonzalez with Ordinance 126395, which I fully supported in 2021 to provide more transparency and accountability with the revenue estimates used by our budget policymakers. Instead of blindly relying on revenue estimates from the executive branch of government, the new office is governed equally by the executive and legislative branches. The forecast updated in April helps the City Budget Director (who reports to the Mayor) and the City Council Finance Committee to determine whether any mid-year budget adjustments are needed. The forecast updated in August helps the Mayor to finalize his budget request for the next calendar year. The forecast updated in November is used by the City Council to finalize its budget amendments and to ensure it will be in balance, as required by State law.

SMALL 2024 DEFICIT: You might hear of a small $9 million deficit. To clarify, that’s over the two-year period (“biennium”) through 2024 and after subtracting grants that we receive from other levels of government for specific purposes (i.e. those grants are not cash that we can move around to plug holes in other parts of our budget, so it often makes sense to “exclude” them from the analysis). The negative $9 million is a logical number to highlight, and it’s good news, because it’s small relative to our total budget.

SURPLUSES: To show the bigger picture (and the existing “surplus”), I have combined and rearranged the revenue estimates (in the table above). You can see that, in 2023, our most flexible General Fund expects a surplus of $74 million. After combining the General Fund with the other funding sources (both positive and negative), we expect a net surplus of $34 million (including grants) and $6.6 million (excluding grants).

NEW REVENUE NEEDED? If we have a surplus this year, why did the Mayor and Budget Chair establish a “Revenue Stabilization Workgroup”? Good question! As city government personnel costs continue to increase at an unsustainable level, we expect larger deficits to return in 2025. But rather than going back to the well of the general taxpayer of Seattle, why not just better manage our costs? If that’s not possible, we know the Washington State Supreme Court recently allowed the State’s new capital gains excise tax to remain. Perhaps Seattle will consider a similar local measure here, although that could put Seattle at a disadvantage relative to other cities.

Regardless, I believe City Hall should apply any new progressive revenue to reducing regressive taxes that we already pay, rather than spending it on additional costs of government. For example, if we introduce a new “progressive” tax in Seattle, we should use it to reduce the sales tax paid today by everyone (especially low-income residents) to boost our bus service and/or to reduce utility taxes that burden our electric and water bills, and/or to reduce the property taxes Seattle homeowners and renters pay to build low-income housing or large transportation projects.

Posted: June 7th, 2023 under Councilmember Pedersen